trust capital gains tax rate 2022

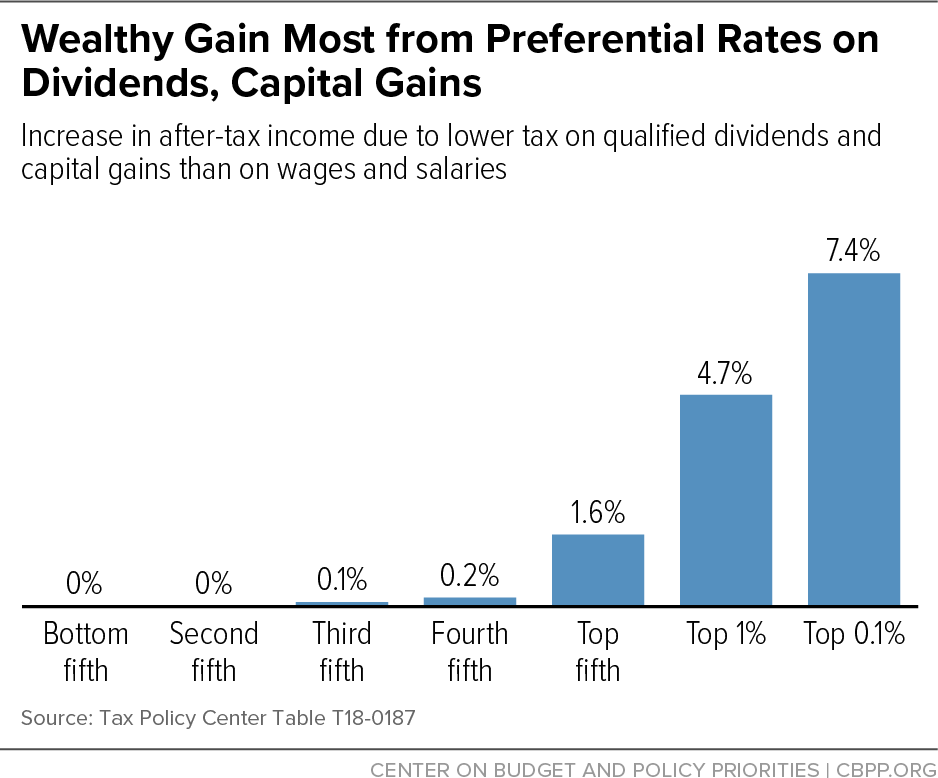

Capital gains and qualified dividends. For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20.

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

If a vulnerable beneficiary claim is made the.

. The financial impact of this tax grows in correlation with the size of your household income. Capital gains taxes on assets held for a year or less correspond to ordinary income tax. For tax year 2022 the 20 rate applies to amounts above 13700.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. For tax year 2022 the 20 rate applies to amounts above 13700. Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital.

2022 Capital Gains Tax Rate Thresholds. The 2022 Capital Gains Tax Rate Thresholds Are Out 1 week ago Nov 10 2021 2022 Capital Gains Tax Rate Thresholds Tax on Net Investment Income. The IRS has already released the 2022 thresholds see table below so you can start planning for 2022 capital asset sales now.

Capital gains and qualified dividends. Short-term capital gains from assets held 12 months or. You would owe capital gains tax on your profit of 5.

However long term capital gain generated by a trust still. The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. Rates of tax.

20 for trustees or for personal representatives of someone who. The following Capital Gains Tax rates apply. What is the capital gains tax rate for trusts in 2022.

Trust Tax Rates and Exemptions for 2022 - SmartAsset 1 week ago Jul 06 2022 2022 Long-Term Capital Gains Trust Tax Rates. The tax rate for capital gains is as low as 0. Events that trigger a disposal include a sale donation exchange loss death and emigration.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act.

2022 Federal Long-Term Capital Gain Rates for Estates and Trusts. The maximum tax rate for long-term capital gains and qualified dividends is 20. The following are some of the specific.

Capital gains on the disposal of assets are included in taxable income. The maximum tax rate for long-term capital gains and qualified dividends is 20. From 6 April 2016 trustees gains are taxed at 28 on residential property or 20 on other chargeable assets.

2022 Capital Gains Tax. Individuals and special trusts 18. Maximum effective rate of tax.

The result of this is that the New Zealand resident beneficiaries are subject to Australian tax at non-resident tax rates between 325 and 45 on capital gains derived from New Zealand. For tax planning purposes determine whether the 0 15 or 20 capital gains rate will apply to you and whether to consider adjusting the timing of capital gains recognition. It continues to be important.

18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you need to work. Maximum effective rate of tax. By comparison a single investor pays 0 on capital gains if their taxable income is.

Capital Gains Tax Rates By State Nas Investment Solutions

2022 2023 Tax Brackets Standard Deduction 0 Capital Gains Etc

2022 Key Planning Figures Fiduciary Trust

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

Tax Advantages For Donor Advised Funds Nptrust

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

The Tax Impact Of The Long Term Capital Gains Bump Zone

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

2022 Capital Gains Tax Rates Federal And State The Motley Fool

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

2022 Key Planning Figures Fiduciary Trust