wyoming llc tax rate

The sales tax rate in Wyoming is 4. Colorado has the lowest sales tax at 29 while California has the highest at 725.

State Corporate Income Tax Rates And Brackets Tax Foundation

A Wyoming LLC also has to file an annual report with the secretary of state.

. Some of the advantages to Wyomings tax laws include. 10 -Wyoming Corporate Income Tax Brackets. Ad Register and Subscribe Now to work on WY LLC Operating Agreement more fillable forms.

Ad Form A Wyoming LLC And Stay Covered All Year With Worry Free Services Support. How to Register for. LLCs under a C-Corporation election that accumulate and do not.

Sales Use Tax Rate Charts. Wyoming LLC Tax Filing Fees. The annual report fee is based on assets located in Wyoming.

Work With Our Trusted Team Of Formation Experts To Form A Fast Simple LLC Online. PdfFiller allows users to edit sign fill and share all type of documents online. 327 to have us form the Wyoming LLC for you.

1000 or so to talk to your local lawyer. An LLCs profits arent taxed at the business level like C Corporations. The tax rate is 20 percent the rate is reduced to 15 percent for certain specific items Accumulated Earnings Tax.

Wyoming LLCs are required to make payments semi-annually. Real Estate Family Law Estate Planning Business Forms and Power of Attrorney Forms. An LLC may elect to be treated as a corporation for tax purposes by filing IRS Form 8832.

Form your Wyoming LLC with simplicity privacy low fees asset protection. If the total value of the businesss in-state assets is under 250000. 4 percent state sales tax one of the lowest in the United States.

If you take the S corp path youll need to pay yourself using a payroll system that helps calculate your payroll taxes. Ad Our 199 LLC formation service includes Bank Account provides everything you need. If you are not resident in the US your Wyoming LLC will only pay tax on US-sourced income.

Performed for the repair assembly alteration or improvement of railroad rolling. Owners pay federal income. Our Business Specialists Help You Incorporate Your Business.

Five states have no sales tax. Owners pay self-employment tax on business profits. The tax is either 60 minimum or 0002 per dollar of.

No entity tax for corporations. 1000 or so to talk to your CPA. As a business owner your payroll taxes are part.

The average property tax rate is only 057 making Wyoming the lowest property tax taker. So your initial costs. Wyomings pioneering past led it to become the first state to create the LLC or limited liability company.

With corporate tax treatment the LLC must file tax return 1120 and pay taxes at the. Tax Bracket gross taxable income Tax Rate 0. Any LLC operating in Wyoming is liable to pay 2 kinds of taxes- state taxes as well as federal taxes.

In conjunction with the annual report you must pay a license tax. You will file Form 1120 as the business was incorporated in the United States. Wyomings license fee amounts to 0002 for every dollar of in-state assets the business has or 60 whichever is greater.

How Do LLCs Pay Taxes in Wyoming. 39-15-105 a viii O which exempts sales of tangible personal property or services. Get a quote from.

Ad Incorporate Your LLC Today To Enjoy Tax Advantages and Protect Your Personal Assets. Wyoming has no corporate income tax at the state level making it an attractive. Instead taxes are as follows.

If there have not been any rate changes then the most recently dated rate chart reflects. Work With Our Trusted Team Of Formation Experts To Form A Fast Simple LLC Online. Ad Form A Wyoming LLC And Stay Covered All Year With Worry Free Services Support.

As the birthplace of the LLC with a business-friendly tax system Wyoming is a great. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Up to 25 cash back For example if your LLC was created on June 15 the annual report is due each year on June 1.

Wyoming ranks in 10th position in the USA for taking the lowest property tax. Taxes for an LLC are charged based on the number of members in your company. In Wyoming an LLC must file an.

No personal income taxes. Tax rate charts are only updated as changes in rates occur.

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

State Income Tax Rates Highest Lowest 2021 Changes

Corporate Tax Rates By State Where To Start A Business

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

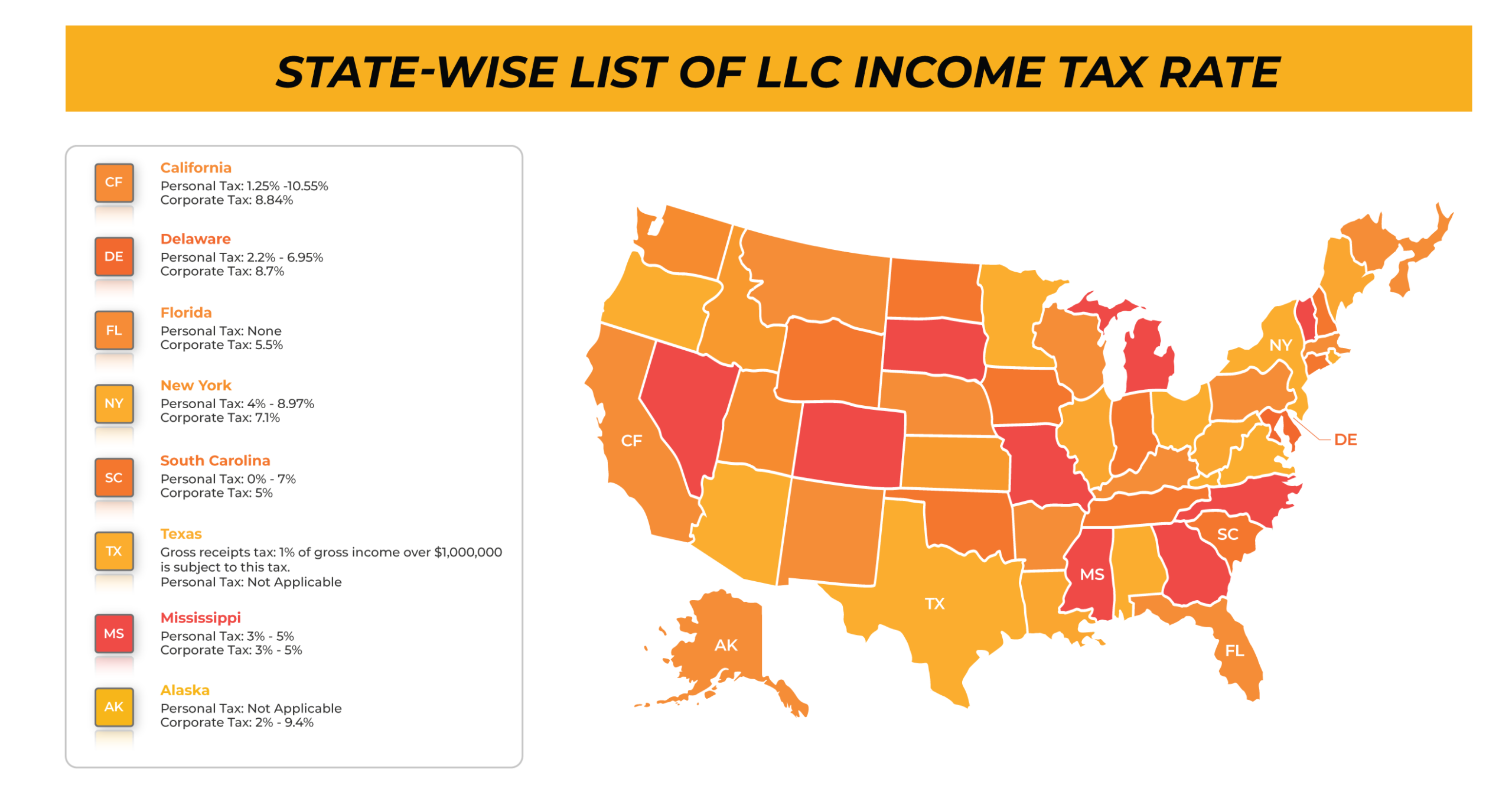

Everything You Need To Know On What Is The Llc Tax Rate Ebizfiling

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Tax Rates To Celebrate Gulfshore Business

5 Smart Things To Do With Your Refi Savings Smart Things Things To Do Done With You

New York State Enacts Tax Increases In Budget Grant Thornton

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Lowest Highest Taxed States H R Block Blog

States With The Highest And Lowest Property Taxes Property Tax Tax States

Everything You Need To Know On What Is The Llc Tax Rate Ebizfiling

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz